Overview

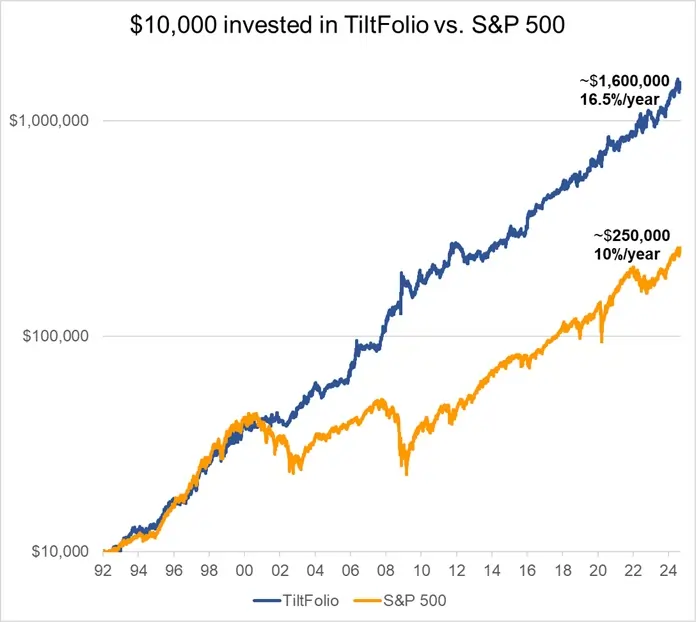

A free model portfolio that both outperforms the S&P 500 by 50% while reducing maximum loss by 50%. You can get the allocations, free forever, from our website - just provide your email address. Here's the longer version: Instead of diversifying across all major asset classes, TiltFolio uses a rules-based system that interprets market signals to forecast the direction of volatility. Based on this outlook, it allocates to the single asset class best suited to the current environment, such as stocks, bonds, or gold. The result? A portfolio that aims to capture higher returns during stable, growth-driven markets, while shifting defensively when turbulence is likely. TiltFolio seeks to outperform even strong asset classes like stocks, but with smaller, faster-recovering drawdowns. It's a disciplined, data-driven strategy designed to help investors grow wealth with more confidence and less stress.