The Ultimate Guide to Market Research for Startups: From Ide

market research for startups: You’ve poured your heart, soul, and probably way too much caffeine into building a product. It’s sleek, it’s functional, a — learn

You’ve poured your heart, soul, and probably way too much caffeine into building a product. It’s sleek, it’s functional, and you’re convinced it’s going to change the world. But then comes the launch. You push the button, and… crickets. Sound familiar? This is the nightmare scenario for every founder, and it almost always stems from one critical oversight: skipping genuine market research for startups.

Let’s be honest. For many indie makers and early-stage founders, "market research" sounds like a stuffy, expensive process reserved for corporations with massive budgets. But what if I told you it’s the single most important step you can take to avoid building something nobody wants? What if it’s the key to not just launching, but launching with impact? This guide is your roadmap to doing just that, even without a hefty budget.

Table of Contents

- Why Market Research for Startups is Non-Negotiable

- The Two Pillars of Startup Market Research

- Primary Research: Getting Your Hands Dirty

- Secondary Research: Standing on the Shoulders of Giants

- A Practical, Step-by-Step Guide to Market Research for Startups

- Step 1: Define Your Burning Question

- Step 2: Sketch Out Your Ideal User

- Step 3: Become a Digital Detective (Secondary Research)

- Step 4: Talk to Actual Humans (Primary Research)

- Step 5: Test, Validate, and Get Early Eyes on Your Product

- Finding Your First Users: Where to Get Feedback and Validation

- Real-World Examples of Market Research for Startups Done Right

- Conclusion: Stop Guessing, Start Validating

- Frequently Asked Questions (FAQs)

Why Market Research for Startups is Non-Negotiable

Building a product without market research is like setting sail without a compass. You might be moving, but you have no idea if you’re heading toward treasure or a storm. The data backs this up.

According to research from CB Insights, a staggering 42% of startups fail because they solve a problem that doesn't exist in a significant market—in other words, "no market need." Think about that. Nearly half of all failed ventures could have potentially been saved by asking the right questions before writing a single line of code.

Effective market research for startups isn't about confirming your biases. It's about challenging them. It’s about replacing "I think" with "I know" and ensuring you’re building a "must-have," not a "nice-to-have."

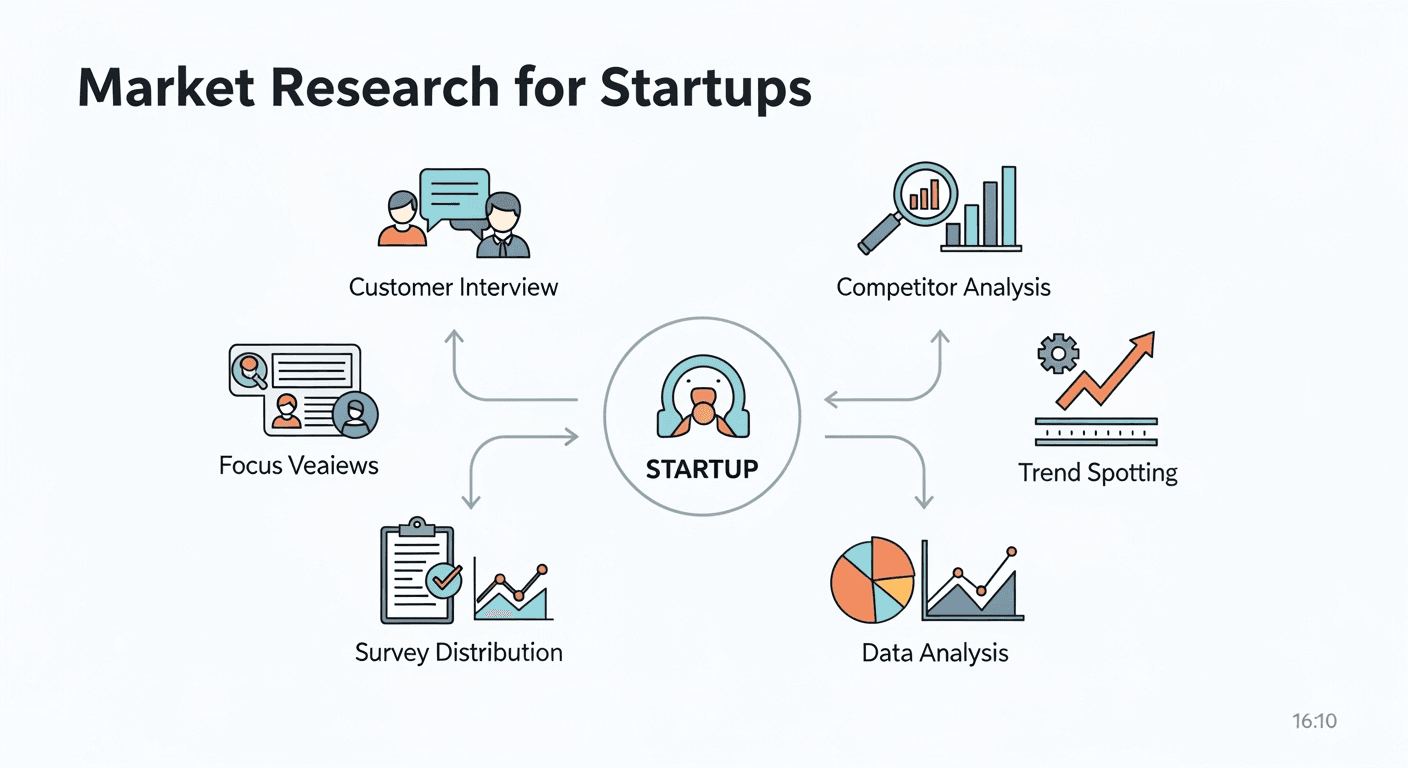

The Two Pillars of Startup Market Research

Market research can be broken down into two core types: primary and secondary. You need a mix of both to get a full picture.

Primary Research: Getting Your Hands Dirty

Primary research is data you collect yourself, directly from the source. It’s tailored specifically to your questions and your product. Think of it as firsthand intelligence gathering.

Methods of primary research include:

- Interviews: One-on-one conversations with potential users.

- Surveys: Using tools like Google Forms (https://docs.google.com/forms/) or SurveyMonkey (https://www.surveymonkey.com) to ask specific questions to a broader audience.

- Observation: Simply watching how people currently solve the problem your product addresses.

The beauty of primary research is that it’s incredibly specific to your needs. You can dig deep into the "why" behind user behavior.

Secondary Research: Standing on the Shoulders of Giants

Secondary research involves analyzing data and information that has already been collected by others. This is where you get the lay of the land—understanding market size, industry trends, and what competitors are up to.

Sources for secondary research include:

- Industry Reports: Publications from firms like Statista (https://www.statista.com) or Gartner (https://www.gartner.com).

- Competitor Websites & Reviews: What are people saying about existing solutions? What features do they love or hate?

- Online Communities: Forums like Reddit (https://www.reddit.com) or niche Facebook groups are goldmines of raw, unfiltered customer opinions.

Secondary research is generally faster and cheaper than primary research, making it the perfect starting point.

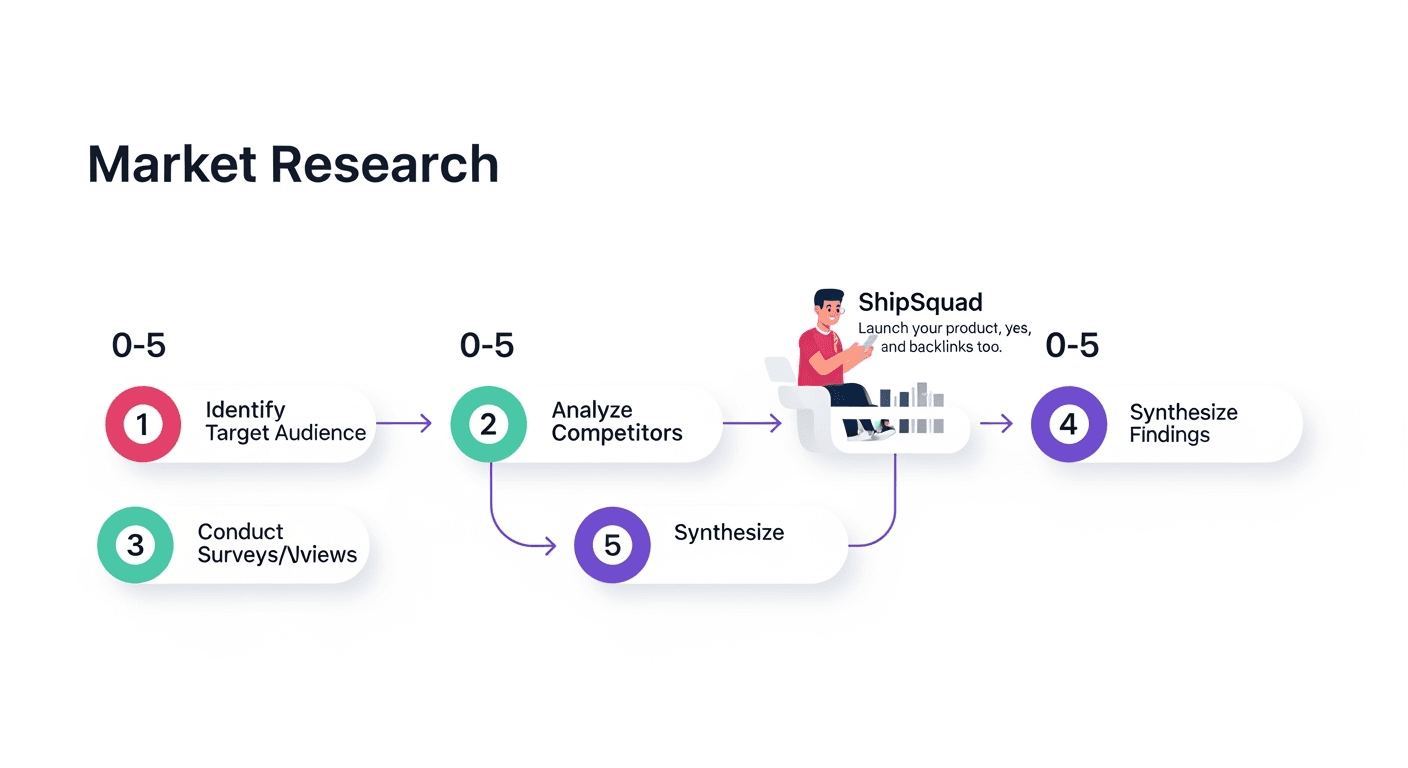

A Practical, Step-by-Step Guide to Market Research for Startups

Step 1: Define Your Burning Question

Before you do anything, you need to know what you’re trying to learn. Vague goals lead to vague results. Start with a clear, specific question.

- Bad: “I want to see if people will like my new project management tool.”

Your question should be a testable hypothesis. It frames your entire research process.

Step 2: Sketch Out Your Ideal User

You can't find answers if you don't know who you're asking. Create a simple "buyer persona"—a semi-fictional profile of your ideal customer. You can use a free tool like HubSpot's Make My Persona (https://www.hubspot.com/make-my-persona) to guide you.

Give them a name, a job title, goals, and, most importantly, frustrations. What keeps them up at night? What are their biggest pain points related to the problem you're solving? This profile will be your guide for finding people to talk to.

Step 3: Become a Digital Detective (Secondary Research)

Now it’s time for some desk work. Dive into secondary sources to understand the broader context of your idea.

- Competitor Deep Dive: Identify 3-5 competitors. Analyze their pricing, features, and marketing language. Read their customer reviews on sites like G2 (https://www.g2.com) or Capterra (https://www.capterra.com) to find their strengths and weaknesses.

- Trend Spotting: Use Google Trends (https://trends.google.com/trends/) to see if interest in your core topic is growing or shrinking. Are people actively searching for solutions to the problem you're tackling?

- Community Listening: Spend time in the online communities where your ideal user hangs out. What tools do they recommend? What problems do they complain about? Don't post about your product yet—just listen.

Step 4: Talk to Actual Humans (Primary Research)

This is the most crucial—and often the most intimidating—step. You need to get out of the building (or off Slack) and talk to the people you identified in Step 2.

- Find Them: Use your network on LinkedIn, reach out to people in relevant online communities, or offer a small incentive (like a $10 coffee gift card) for 15 minutes of their time.

- Ask Open-Ended Questions: Don't pitch your solution. Your goal is to understand their problem deeply.

- "Tell me about the last time you dealt with [the problem]."

- "What was the hardest part of that?"

- "What, if anything, have you tried to do to solve this?"

- "How are you currently handling that today?"

- Listen More Than You Talk: You're looking for pain points, workarounds, and emotions. If people aren't passionate about the problem, they're unlikely to pay for a solution.

Step 5: Test, Validate, and Get Early Eyes on Your Product

After your initial research, you should have a much clearer picture of the problem. Now it's time to validate that your solution is the right one. This is where many founders get stuck. You have an early version of your product (an MVP, or Minimum Viable Product), but no audience to show it to.

This is exactly the problem that platforms designed for early-stage builders aim to solve. While traditional launch platforms can be noisy and require an existing network, newer solutions focus on creating a supportive ecosystem for validation. This is where getting early feedback, initial users, and even SEO-boosting backlinks becomes critical. A well-placed launch can serve as a powerful form of market research for startups, giving you real-world data on how users interact with your product.

Finding Your First Users: Where to Get Feedback and Validation

Once you have an MVP, you need to get it in front of people. But where do you go when you have zero followers and no marketing budget? Here’s a comparison of a few options for indie makers and early-stage founders.

| Platform | Best For | Pricing | Key Feature | SEO Benefit |

|---|---|---|---|---|

| Product Hunt | Products with existing buzz and a network for upvotes. | Free to submit. | Large, established audience; potential for massive single-day traffic. | Nofollow links; SEO benefit is indirect (brand mentions). |

| BetaList | Pre-launch startups looking to build a waitlist. | Free (with a long wait) or paid options to skip the line. | Exclusively for un-launched products; attracts early adopters. | Minimal direct SEO benefit. |

| Indie Hackers | Building in public and getting community feedback. | Free. | Strong community of fellow founders and developers. | Forum links are generally nofollow; value is in the community. |

| ShipSquad (shipsquad.space) | Indie makers needing validation, early users, and SEO growth without costs. | Free. | Guaranteed visibility with a curated community of early adopters; focus on constructive feedback. | Directly provides quality, dofollow backlinks, offering a unique and tangible SEO advantage from day one. |

Featured Solution: ShipSquad

For founders in their first product launch phase, the challenge isn't just visibility; it's getting the right kind of visibility. You need feedback from genuine early adopters, not just a fleeting spike in traffic. More importantly, you need to build a long-term foundation for growth.

This is where ShipSquad (shipsquad.space) carves out its unique space. It’s built specifically for indie builders who are launching without an audience. The platform’s core value lies in three areas:

- Guaranteed Early Eyes: Your product gets seen by a community actively looking to test new things.

- Actionable Feedback: The community is geared toward providing constructive input to help you iterate.

- Real SEO Growth: Unlike other platforms, ShipSquad provides valuable backlinks, helping your new product get indexed and start building domain authority with search engines. This is a massive, often overlooked, advantage for long-term organic growth.

Ready to stop building in the dark? Launching your MVP on a platform like ShipSquad isn't just a launch—it's the ultimate act of market research for startups. Launch your product, get early eyes, and backlinks too.

Real-World Examples of Market Research for Startups Done Right

Theory is great, but let's look at how this works in practice.

Case Study 1: Dropbox (https://www.dropbox.com) - The Power of a Simple Video

Before building their complex file-syncing technology, founder Drew Houston created a simple explainer video. The video demonstrated what Dropbox would do and was shared with a community of tech early adopters. He wasn't testing the code; he was testing the concept. The sign-up list exploded overnight, validating the massive market need before they invested heavily in development. This was pure, effective market research for startups.

Case Study 2: Buffer (https://buffer.com) - The Landing Page Test

Joel Gascoigne, the founder of Buffer, wanted to know if people would pay for a social media scheduling tool. Instead of building it, he created a simple landing page that described the product. If a user clicked on the "Plans & Pricing" button, a message appeared explaining the product wasn't ready yet but they could sign up for a waitlist. When enough people clicked, he added a real pricing page to test willingness to pay. He validated both interest and commercial viability without writing a line of production code.

Case Study 3: "CodeNotes" (A Hypothetical Example)

An indie developer named Sara builds a niche app for developers to organize code snippets. She has no audience. Instead of a big, splashy launch, she submits "CodeNotes" to ShipSquad (shipsquad.space).

- The Challenge: Sara needed to know if her UI was intuitive and if there were any missing features that developers considered essential.

- The Solution: She launched on ShipSquad for free.

- The Results: Within a week, she received over 20 detailed feedback comments from other developers. They loved the core concept but pointed out a critical missing feature: integrations with popular code editors. She also got a valuable backlink that helped her new domain get noticed by Google. This feedback was pure gold. She spent the next month building the integration and re-engaged with the users who provided feedback, turning them into her first loyal customers.

Conclusion: Stop Guessing, Start Validating

In the world of startups, your initial idea is just a starting point. The journey to success is paved with feedback, iteration, and a deep understanding of your customer. Market research for startups isn't a one-time task; it's a mindset. It's the continuous process of listening, learning, and building what people truly want and need.

Don't let the fear of "no market need" be the ghost in your machine. By using a combination of scrappy secondary research, genuine conversations, and smart validation platforms, you can dramatically de-risk your venture.

When you're ready to move from research to the real world, consider a platform that does more than just showcase your product. A launch on ShipSquad (shipsquad.space) gives you what every early-stage founder craves: validation from real users, actionable feedback to guide your next steps, and a foundational backlink to kickstart your SEO journey. It’s the perfect first step to ensure you’re not just launching, but launching in the right direction.

Recommended Videos

Frequently Asked Questions (FAQs)

1. How much does market research for startups typically cost?

It can cost anywhere from $0 to tens of thousands of dollars. For early-stage startups, you can conduct highly effective research for free by leveraging tools like Google Trends, online forums, and conducting your own user interviews. The key is to be scrappy and resourceful.

2. What is the single most common mistake founders make in market research?

The biggest mistake is asking leading questions to confirm their own biases (e.g., "Don't you think this feature is great?"). Effective research is about listening and learning, not seeking validation for your existing beliefs.

3. How many people should I interview for my primary research?

4. What's the difference between market research and user testing?

Market research is broader and often happens before a product is built; it's about validating the problem and the market need. User testing is more specific and happens once you have a prototype or product; it's about evaluating the usability and functionality of your solution.

5. How can a platform like ShipSquad help with market research?

Launching your MVP on ShipSquad is a form of live market research. Instead of asking people if they would use your product, you get to see if they actually use it. The feedback, user behavior, and interest you gather are invaluable data points that are far more reliable than hypothetical survey answers.

6. Why are backlinks important for a brand new product?

Backlinks from reputable sites signal to search engines like Google that your website is credible and valuable. For a new product with a new domain, getting even one quality backlink can significantly speed up how quickly you get indexed and start showing up in search results, driving long-term organic traffic.